Accounting and Finance Questions Bank

A mix of questions on the following topics

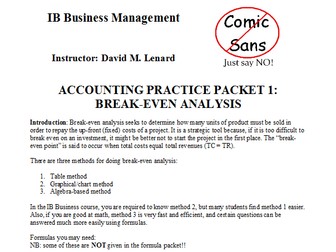

Breakeven

Costings

Mix and Match Cards - Difference between Financial and Management

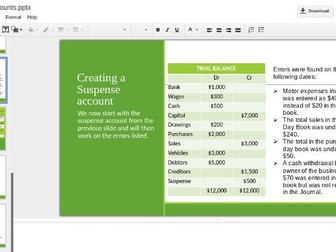

Accounting

Ratio Analysis - Acid Test, Current Ratio, ROCE, Gross Profit

Have used these questions as class room topics as well as stretch and challenge with students studying the following topics

BTEC Business

A Level Business

AAT Accounting

A Level Accounting

GCSE Business Studies